Unlock Financial Connectivity with Our

Open Banking Solution

In a world that thrives on connectivity, our Open Banking solution enables seamless access to financial data and services, empowering your business to harness the power of secure and compliant data sharing. With FinLabCore, embrace the future of finance by offering a transparent, flexible, and customer-centric experience.

Why Choose Our Open Banking Solution?

Our Open Banking solution empowers customer-centric innovation through secure data sharing, enabling personalized services and deeper customer relationships. Built on advanced compliance standards, it ensures data privacy with cutting-edge security protocols. With seamless API integration, it connects effortlessly to existing systems, providing comprehensive financial connectivity. Benefit from cost-efficient scalability, real-time insights, and streamlined account aggregation, enhancing the financial experience for customers and expanding your business offerings.

Empower Customer-Centric Innovation

At the core of our Open Banking platform is the commitment to putting customers first. Enable your customers to share financial data securely across trusted third-party providers, creating opportunities for personalized services, innovative solutions, and enhanced customer satisfaction.

Advanced Security and Compliance Standards

Built on the latest regulatory standards, including PSD2 and GDPR, our Open Banking solution ensures that data sharing remains secure, private, and compliant. With cutting-edge encryption and multi-layered authentication, your customers can trust the integrity of every transaction and data exchange.

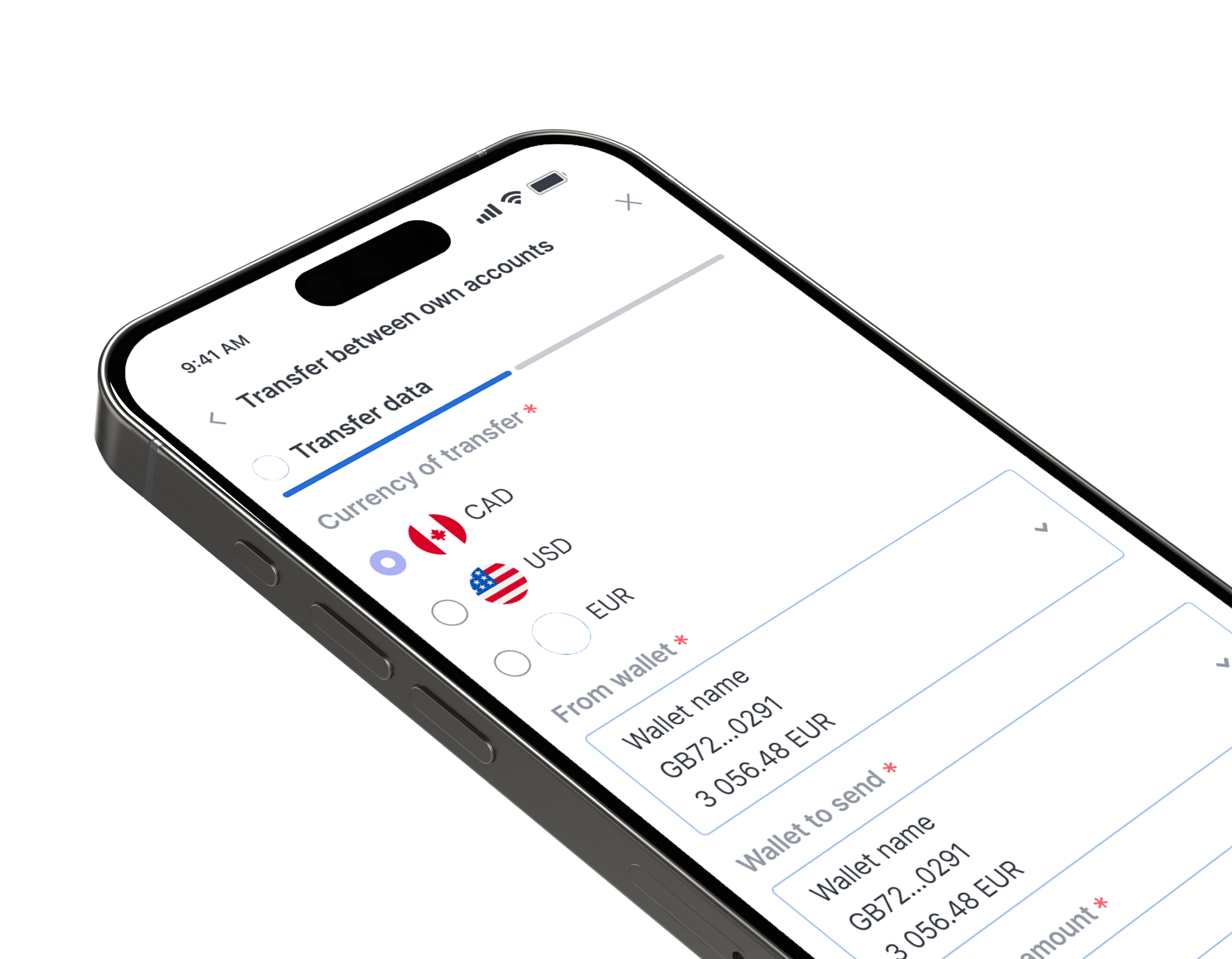

Seamless API Integration

Our robust, developer-friendly APIs simplify integration with your existing systems and third-party applications, making it easier than ever to offer Open Banking services. Whether enhancing digital wallets, connecting to fintech apps, or creating unique financial products, our APIs are designed for adaptability and scalability.

Expand Your Offerings with Data-Driven Insights

Leverage customer insights for better decision-making and targeted service offerings. With access to aggregated financial data, you can deliver personalized recommendations, tailored credit assessments, and other data-driven services that strengthen customer loyalty and drive revenue

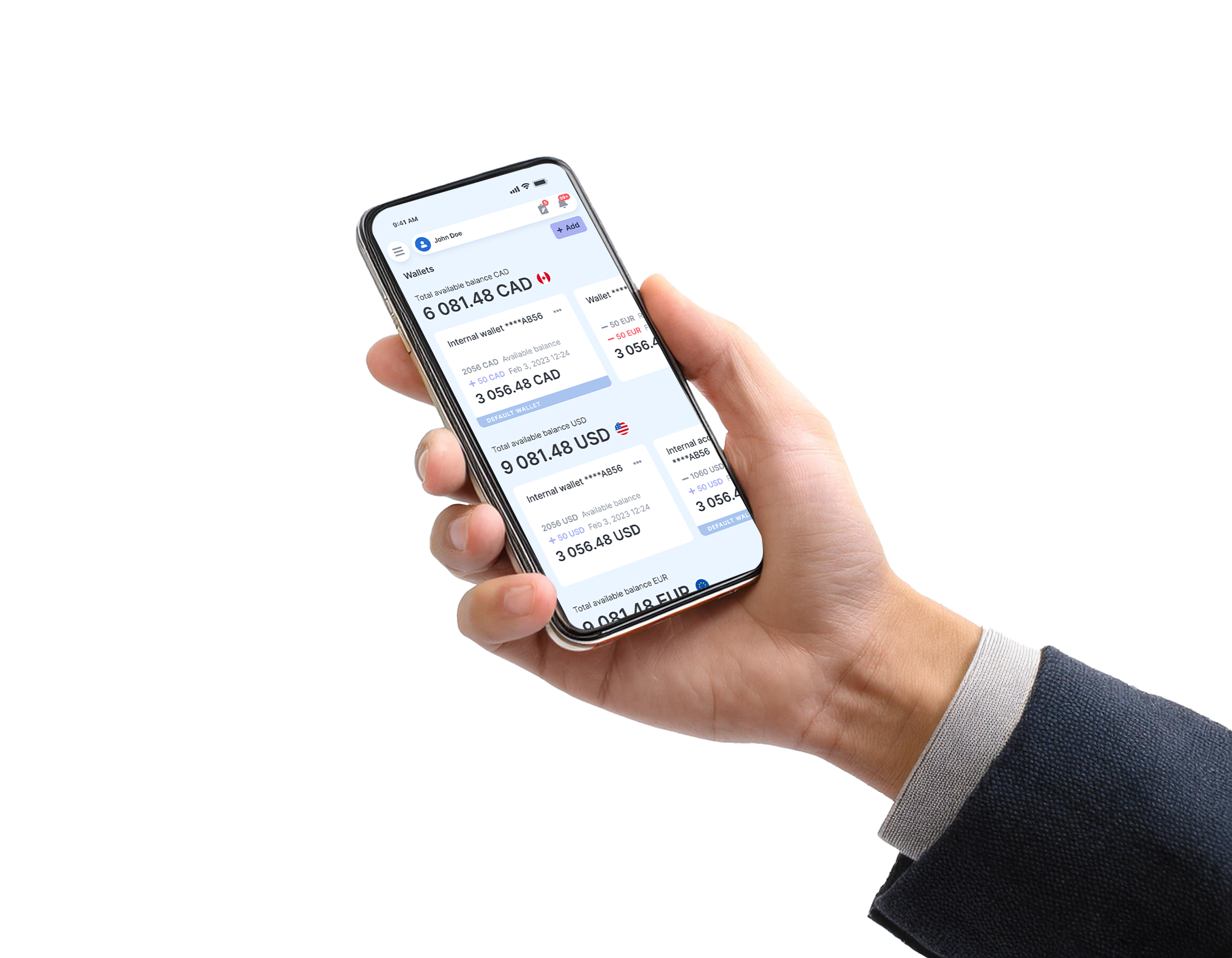

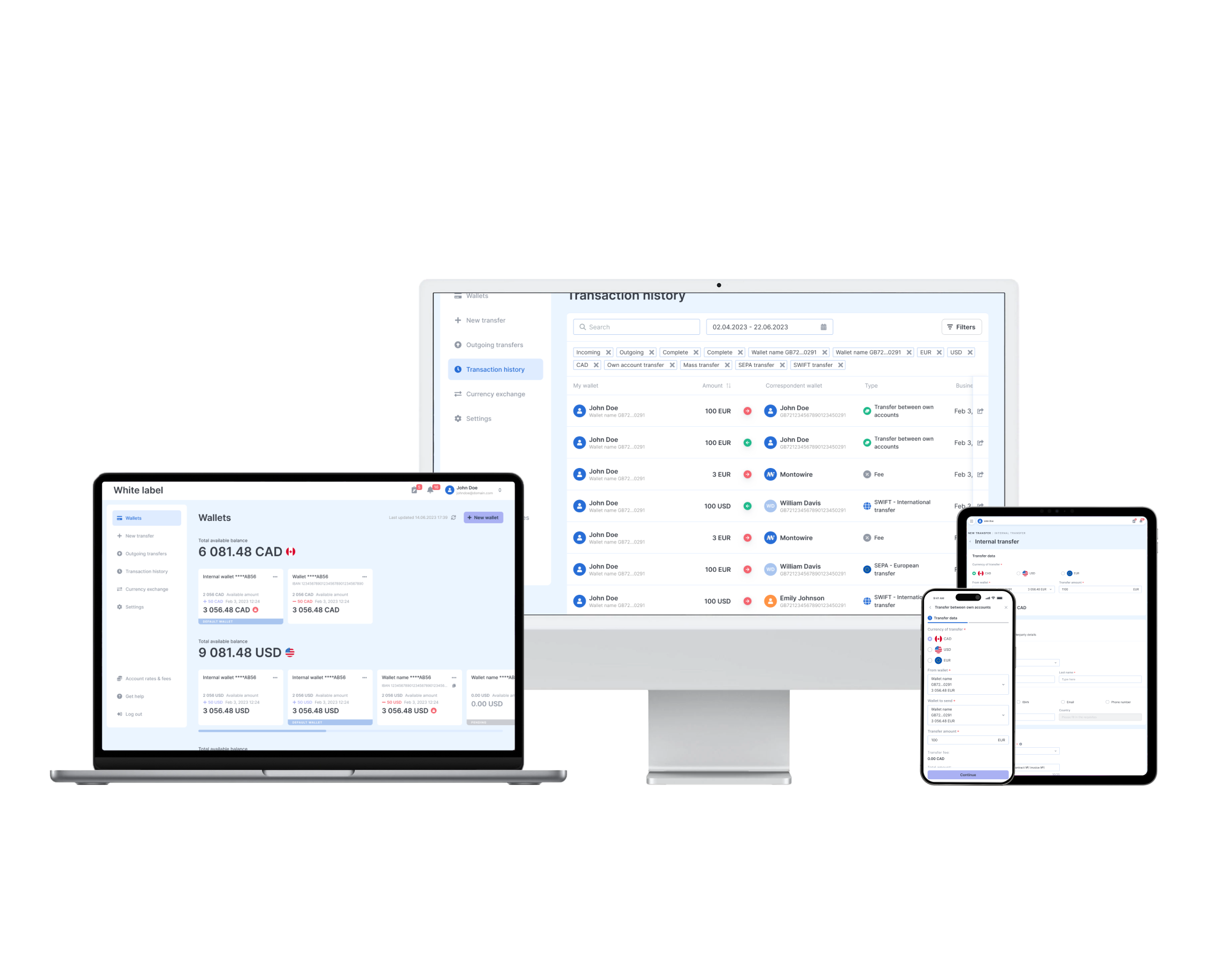

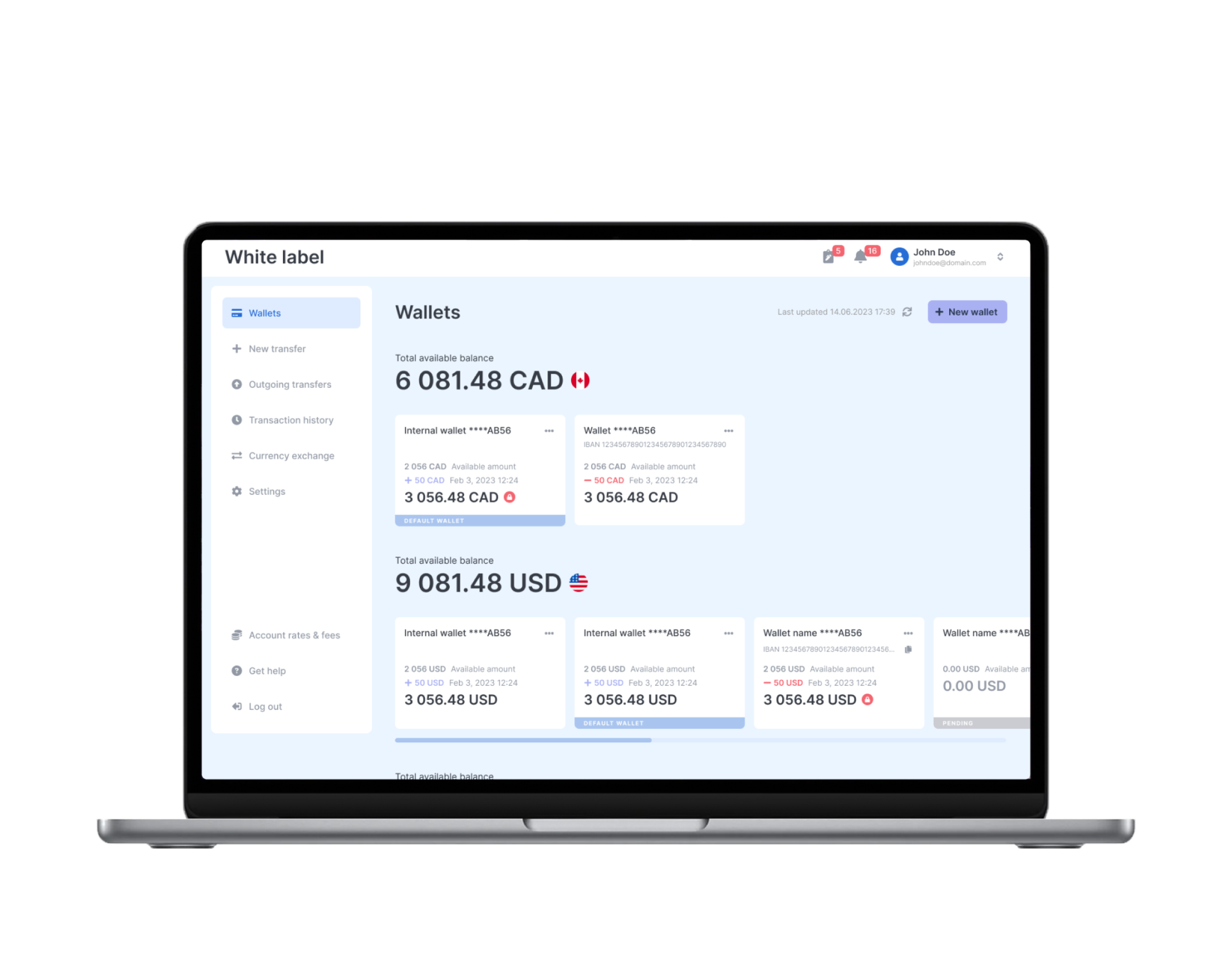

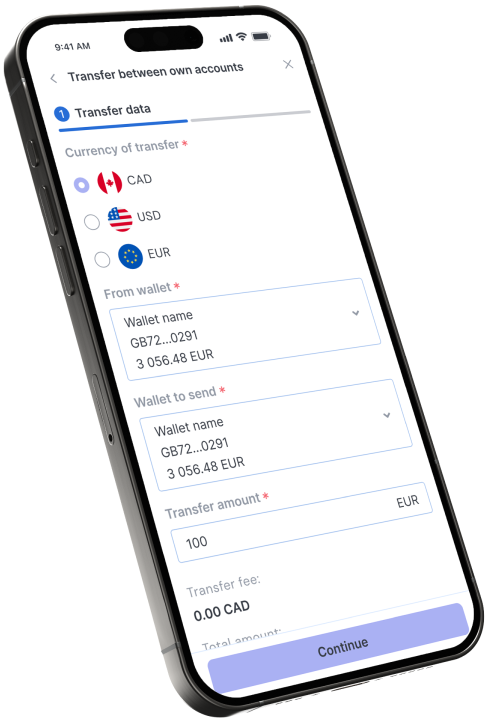

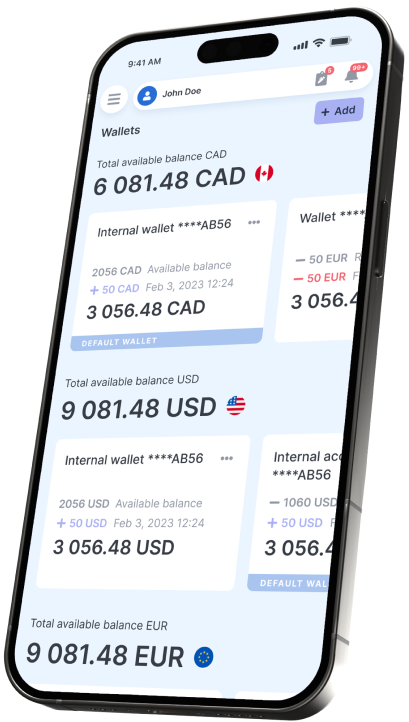

Comprehensive Financial Connectivity

Our Open Banking solution is compatible with multiple account types, from traditional bank accounts to digital wallets, making it easy to unify and manage finances across platforms. Enable customers to view, manage, and transfer funds from one centralized interface, enhancing their control over financial health.

Streamline Account Aggregation

Facilitate consolidated account views for your customers, integrating multiple bank accounts, credit cards, and payment solutions into one easy-to-manage platform. With our Open Banking platform, customers can monitor their financial status in real time, simplifying budgeting, spending, and investing.

Cost-Efficient and Scalable

Our Open Banking solution is built to scale with your business, accommodating increased data flows and customer demands without compromising on performance. Reduce infrastructure costs and focus on service innovation with a platform that grows alongside your business.